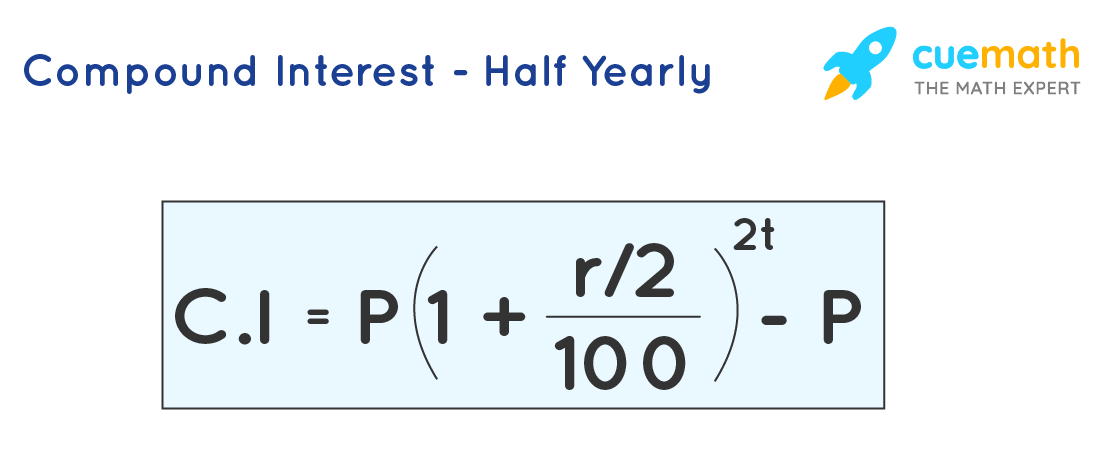

Compounded semiannually formula

18 with Semiannually compounding frequency. He is going to receive 3 semi-annual compound interest.

Word Problems Compound Interest Video Lessons Examples And Solutions

Thought to have.

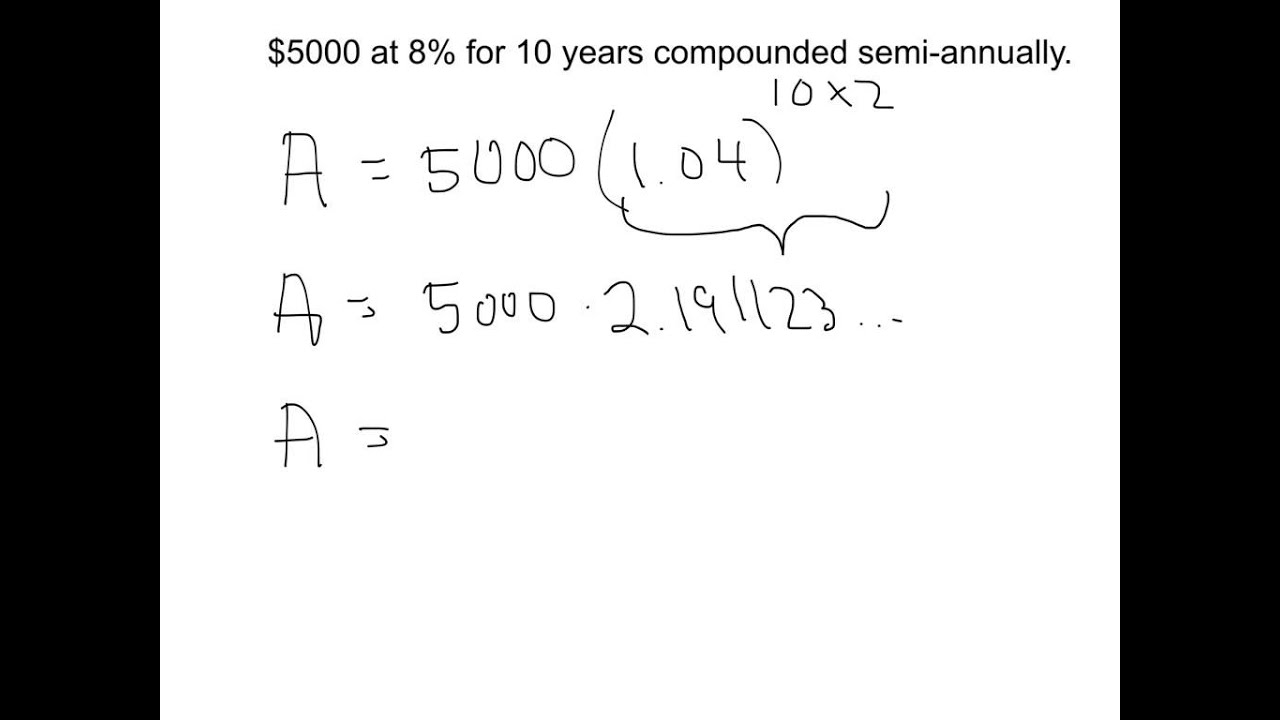

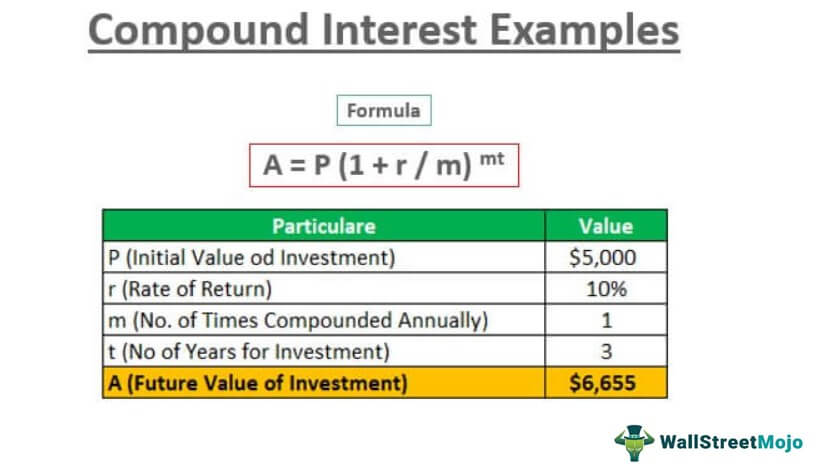

. N 1 for Annually 2 for Semiannually 4 for Quarterly or 12 for Monthly r Market interest rate. So we set up our sample data as follows. Find the effective rate corresponding to a stated rate of 6 compound semiannually.

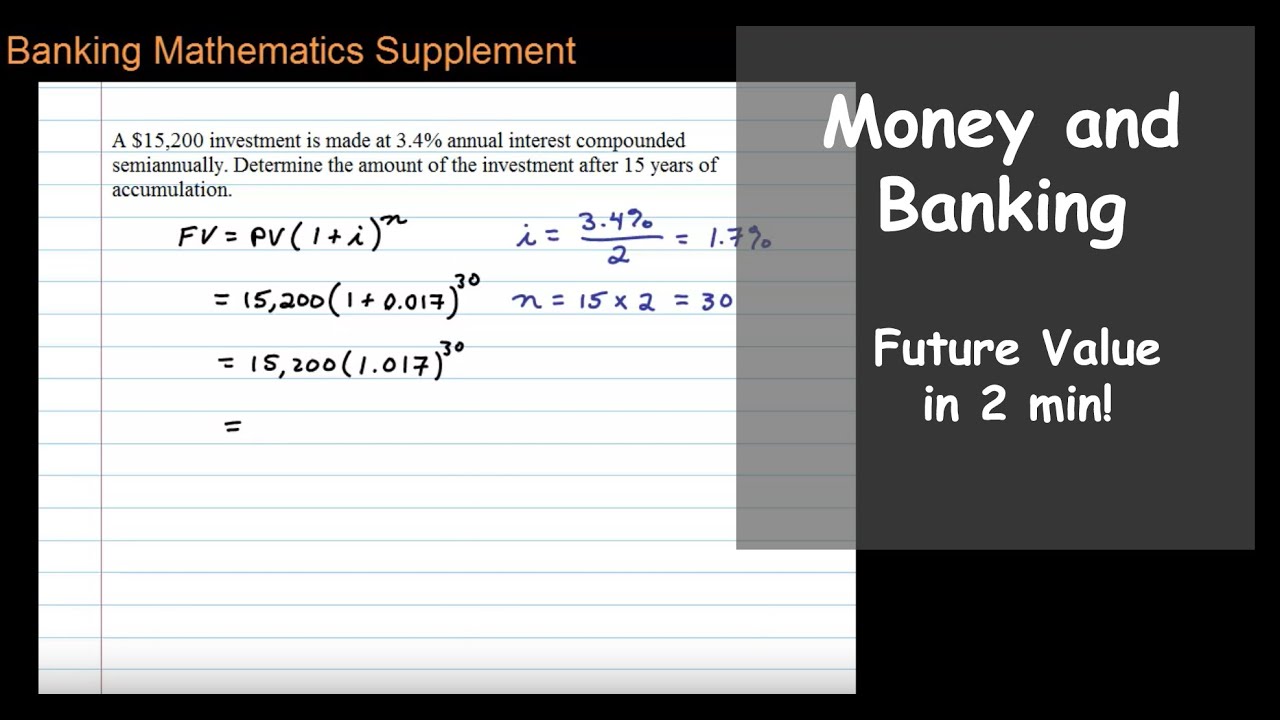

The basic future value can be calculated using the formula. As shown in the image below the same formula determines the future value based on quarterly savings equally well. The formula to calculate compound interest is-P1in-1 Here is an example of how interest is compounded semi-annually-A person invests Rs.

Where FV is the future value of the asset or investment PV is the present or initial value not to be confused with PV which is calculated backwards from the FV r is the Annual interest rate not compounded not APY in decimal t is the time in years. To use the general equation to return the compounded interest rate use the following equation. How to calculate interest compounded semiannually.

If the interest is compounded Quarterly. C f x 2 is. PMT 100 semiannually starts at the end of the first 6 months What is the PV.

B When x 2 y is about 28 so f 2 28. By formula 1 B 1 1 011000 101 1000 1010. Using the second version of the formula the solution is.

SOLUTION Here the initial balance is 1000 and i 1 01. This amounts to a daily interest rate of. Today is the same concept as time.

Include additions contributions to the initial deposit or investment for a more detailed calculation. F Facepar value. 5000 PMT 1 6 1-11610 PMT 1 67934 2.

Let B 1 be the balance at the end of the first interest period and B 2 be the balance at the end of the second interest period. First change the interest rate to decimal- 3100 003. The following formula can be use d for calculating the effective rate.

Determine how much your money can grow using the power of compound interest. According to the formula. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate.

FV formula for lump-sum investment. In this section we will learn how to compare different interest rates with different com-pounding periods. N Coupon rate compounding freq.

C Coupon rate. Lets use the following formula to compute the present value of the maturity amount only of the bond described above. The interest can be compounded annually semiannually quarterly monthly or daily.

The algorithm behind this bond price calculator is based on the formula explained in the following rows. A t 365 2 A t. Examples Use the EFFECT Worksheet Function.

Simple and Compound Interest If you can borrow money at 8 interest compounded annually or at 79 compounded monthly which loan would cost less. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. Here are the steps to solving the compound interest formula.

Compounded semiannually g4 annually PMT 100 annually start at the end of the first year. What interestreturn rate should an investment generate in order to reach certain future value. Using the formula above depositors can apply that daily interest rate to calculate the following total account value after two years.

PV of Constant annuity. An investment of 100 pays 750 percent compounded quarterly. PV 1 PMT 1 r 1.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. Formula is appropriate for a given problem. A The point 1 2 is on the graph of f so f 1 2.

Calculation Using the PV Formula. Now if you earn 609 interest on. Assume that the 1000 in the savings account in the previous example includes a rate of 6 interest compounded daily.

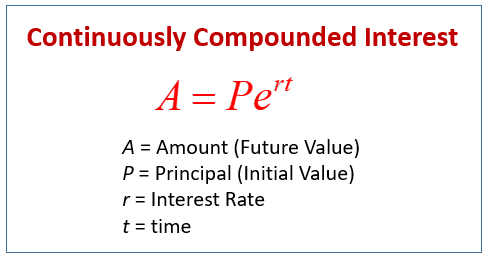

It is an extreme case of compounding since most interest is compounded on a monthly quarterly or semiannual. Continuous compounding is the mathematical limit that compound interest can reach. Lets consider that an individual deposits initially 100000 and that he makes at the end of each year an additional contribution of 5000 over the next 20 years.

The answer 8573 tells us that receiving 100 in two years is the same as receiving 8573 today if the time value of money is 8 per year compounded annually. Years at a given interest. The money is left in the account for two years for example.

Similarly applying formula 1. Determine the number of compounding terms. The number P of cocoons a certain wasp will parasitize in a day depends on the number n of cocoons per square inch that are present.

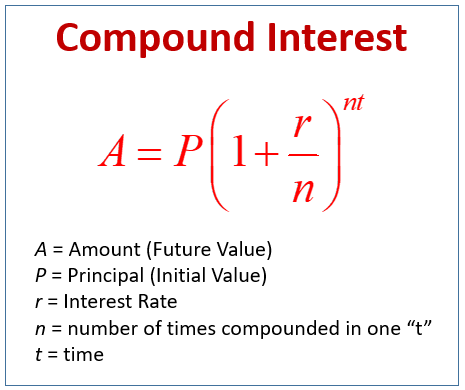

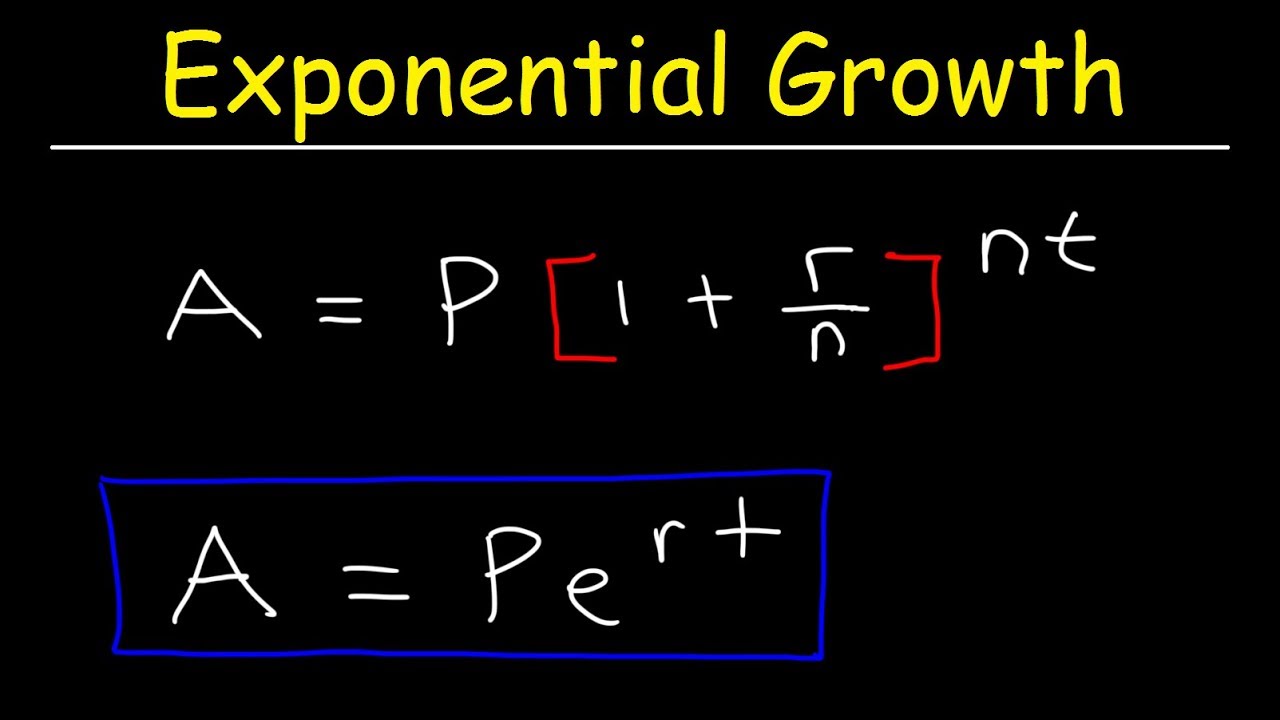

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. The relationship is given by 2162n 1244m A. The formula for compounded interest is based on the principal P the nominal interest rate i and the number of compounding periods.

Section 51 ends with a summary of formulas. In exercises requiring estimations or approximations your answers may vary slightly from the answers given here. A calculator shows that 100 at 6 compounded semiannually will grow to A10010622 1001032 10609 Thus the actual amount of compound interest is 10609 100609.

The following formula returns the compounded interest rate. Find the number of cocoons per square inch will cause the wasp to parasitize 6 of them. The maturity amount which occurs at the end of the 10th six-month period is represented by FV The present value of 67600 tells us that an investor requiring an 8 per year return compounded semiannually would be willing to invest 67600 in return for.

See how much you can save in 5 10 15 25 etc. At the end of this period you extended the loan for 3 years without the interest being paid but the new interest is 10 compounded semi-annually. If you choose to invest money as a one-time lump sum payment the future value formula is based on the present value pv rather than periodic payment pmt.

The detailed explanation of the arguments can be found in the Excel FV function tutorial. The formula you would use to calculate the total interest if it is compounded is P1in-1. Of years until maturity.

Ods for a deposit of 1000 at 2 interest compounded semiannually. The present value formula for a single amount is. 6000 in an investment for five years.

Compounding Semi Annually Quarterly And Monthly Youtube

Compound Interest Formulas Derivation Solved Examples

Mathematics Of Compounding Accountingcoach

Word Problems Compound Interest Video Lessons Examples And Solutions

Compound Interest Formula And Financial Calculator Excel Template

Present Value Frequency Of Compounding Accountingcoach

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Mathematics Of Compounding Accountingcoach

Compound Interest Definition Formulas And Solved Examples

Compound Interest Examples Annually Monthly Quarterly

Quarterly Compound Interest Formula Learn Formula For Quarterly Compound Interest

Mathematics Of Compounding Accountingcoach

Compound Interest Equation Store 55 Off Www Ingeniovirtual Com

Compound Interest Ci Formulas Calculator

Future Value With Interest Compounded Semiannually Youtube