38+ calculate mortgage interest deduction

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Ad Use Our Online Mortgage Calculators For Home Purchase or Mortgage Refinance.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

. Web The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web 7 hours agoThe current average rate on a 30-year fixed mortgage is 707 compared to 692 a week earlier.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Multiply line 13 by the decimal. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Web To take the mortgage interest deduction youll need to itemize. Web Total amount of interest that you paid on the loans from line 12 not reported on form 1098. However higher limitations 1 million 500000 if married.

Web As of 2018 youre allowed to deduct the interest on up to 750000 of mortgage debt although the old limit of 1 million applies to loans that were taken out. Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year.

Also you can deduct the points. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Calculate Your Monthly Payment With Our Mortgage Loan Calculator.

Web Mortgage Tax Calculator. The interest paid on a. Divide line 11 by line 12.

Yes you can include the mortgage interest and property taxes from both of your homes. Homeowners who bought houses before. 750000 if the loan was finalized after Dec.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. For borrowers who want a shorter mortgage the average rate on. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web March 5 2022 246 PM. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

Include in column b of line 10 the amount of. For tax year 2022 those amounts are rising to. Itemizing only makes sense if your itemized deductions total more than the standard deduction.

936 for more information about figuring the home mortgage interest deduction and the limits that may apply. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. However the deduction for mortgage interest.

If you are single or married and. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Tax Deduction Calculator Navy Federal Credit Union

Mortgage Interest Deduction Tax Calculator Nerdwallet

Latitude 38 March 1993 By Latitude 38 Media Llc Issuu

Doc A Third Critique Of Neo Liberalism A Manifest Of Covert And Overt Concepts For The Existential Re Construction Of The Political Economy Noel Tointon Academia Edu

Race And Housing Series Mortgage Interest Deduction

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Tax Deduction What You Need To Know

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Tax Deduction Calculator Freeandclear

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

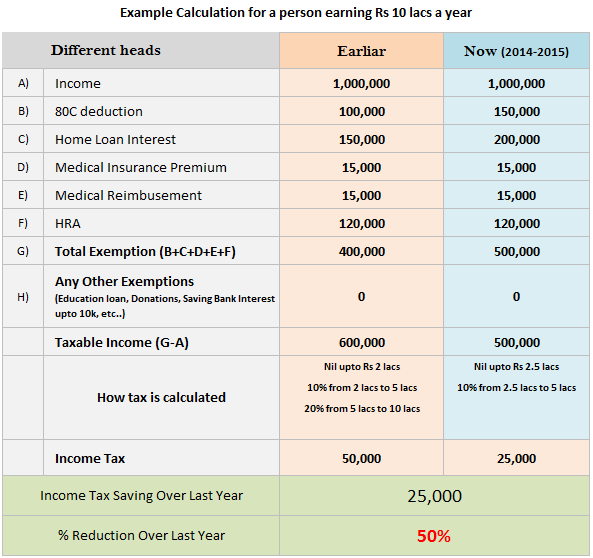

50 Saving In Your Income Tax Due To Budget 2014 Download Calculator

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 65 Loan Agreement Form Example In Pdf Ms Word

Home Mortgage Interest Deduction Calculator